SleepDrops | $2 million funding target, min of $500,000 reached!

By Kirsten Taylor

PledgeMe.Investment

NZ $805,052 pledged

384 people pledged

Closed

NZ $500,000 minimum target

This campaign was successful and closed on 28/12/2018 at 5:00 PM.

Make a PledgeAbout

SleepDrops | $2 million funding target, min of $500,000 reached!

Letter from Kirsten

Like all good yarns worth telling, the SleepDrops story starts with a heroine making the BRAVE decision to start her business in a global financial crisis with no money and just sheer guts, blood, sweat and determination to turn her own situation around whilst helping others….

When I started making herbal formulations of sleep and stress remedies for my clients in my naturopathic clinic I didn’t realise what I had opened myself up for! As a single mum struggling to feed her young son I was determined to find a way to provide for us both that was in alignment with my values and met my deep desire to help people. I knew sleep or lack of it was having a huge impact on my previous clients and with the stress I was under in a global financial crisis, I too was lying awake at night worrying and unable to sleep – until I took one of my own remedies.

The rest as they say is history. What started with me making 1 product – every single bottle by hand and printing labels on the home printer – has turned into a committed company with 4 ranges and 20 individual products. All meeting the needs of a growing sleep deprived and struggling human population. Our mission from day one has been to create and produce innovative sleep and stress support remedies for all ages and to inspire people about the importance of sleep.

In the nine years since this all began we’ve helped raise the awareness of the importance of sleep dramatically in NZ, been featured on ‘60 minutes’ and numerous TV, radio and magazine segments, grown the sleep category in NZ pharmacies by over 20% in our first year, created a whole new range of sleep remedies and learnt a lot about what it means to be a “real player” which is how people refer to you when you reach the top of your field.

Our small team knows how to punch above its weight, delivering excellence in not only the products we make but in our reputation as a company of integrity. We often stop to reflect on just how far we have come, up against multi-million-dollar supplement companies with entire marketing teams and All Black sponsorship! I am often heard saying “imagine what we could do if we had some funding.”

SleepDrops has a team of 10 very talented and loyal people, e–commerce websites in multiple languages, and our own factory. We make it possible for over 90,000 Kiwi’s a year to sleep better every night.

We have a clear strategy. We know what products to develop, manufacture and market, and what channels to put our efforts into. We are more than excited because our dominos are lined up.

The world sleep market is BOOMING and SleepDrops is well placed to become a major player.

When asked what our plans are the answer is simply “global domination”. Good things are worth planning and waiting for. We have spent 3 years getting ready. Now we are ready! We want to take you with us – Let’s go!

What is our Why?

Our Why is we are 100% positive that the world would be a better place if everyone could achieve deep, restorative, rejuvenative, life enhancing sleep.

What we do

SleepDrops has created and produced specialist sleep and stress support product ranges, offering a world first for innovative sleep support options that are for all ages and life stages.

We take sleep very seriously.

Every product we develop is devoted to fulfilling a deep and specialised need for our customers. We meticulously research ingredients in order to develop products that offer something quite spectacular for the user. We aim to impress on many levels. Whether it be superior absorption for ultra fast support, specialised formulations for specific indications, flexibility of dosing, or the ability for our customers to combine products to make their own sleep support programme. We aim to create products that support impactful, life changing sleep.

We are ready!

SleepDrops has spent the last 3 years:

- Consolidating its position

- Readying itself for global expansion

- Building its brand loyalty in it’s home base

- Ensuring for success by taking care of legals (Intellectual Property)

- Building a factory to remove vulnerabilities in manufacturing

- Securing a lease for a long-term home ensuring we can invest in a factory that can ramp up as demand increases

- Open up more channels – supermarkets, practitioners, corporate etc

- Developing products to meet the demand we know exists

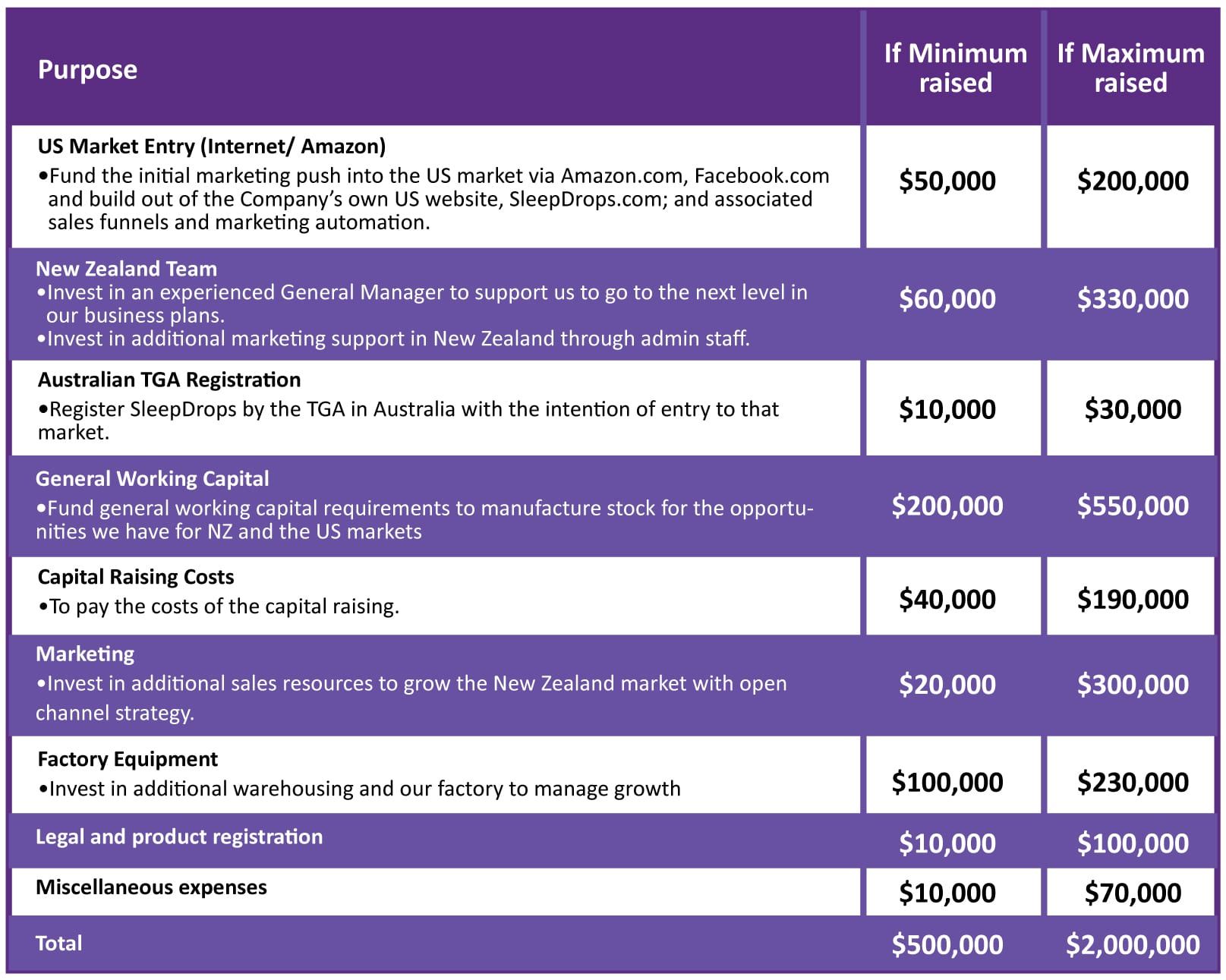

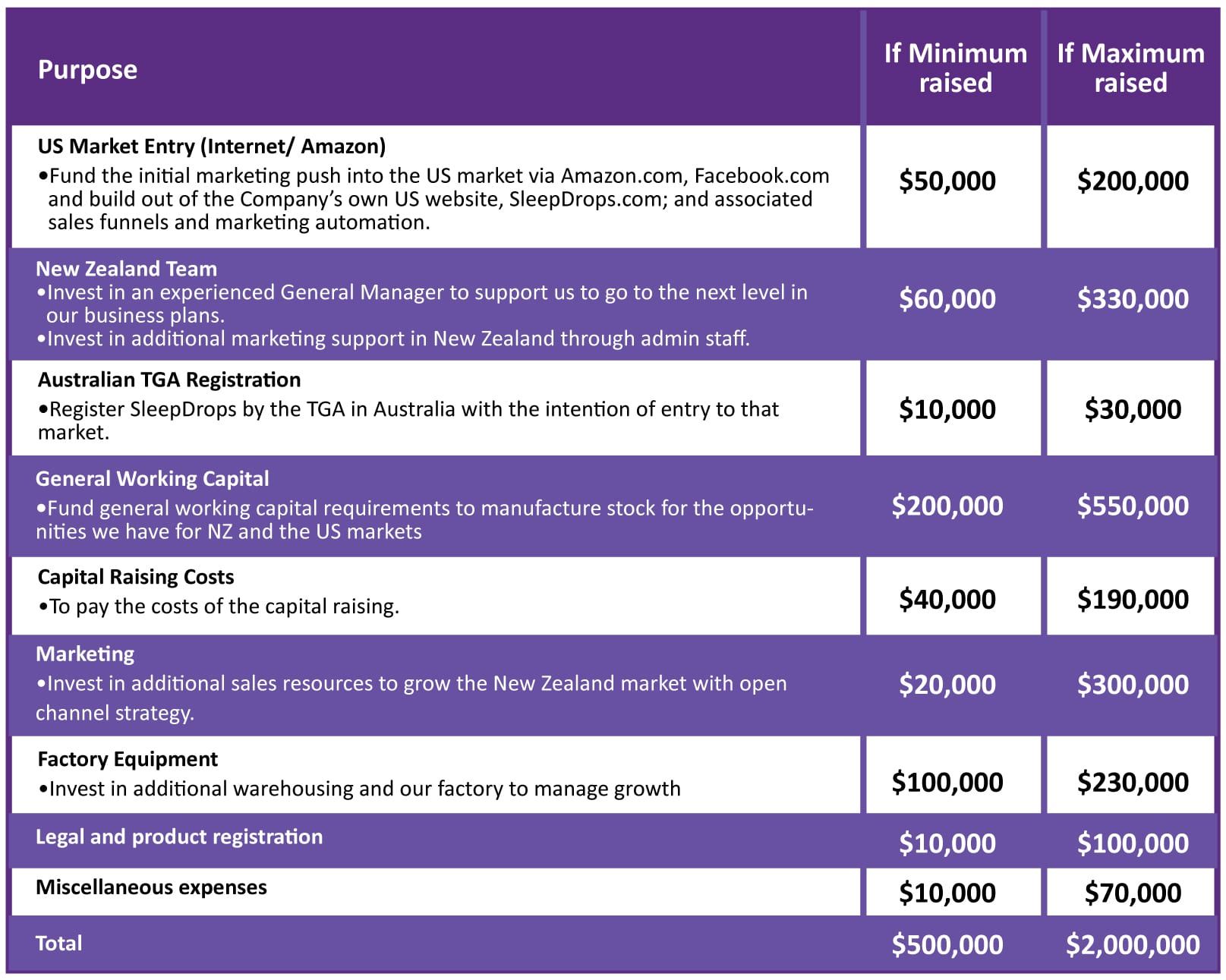

What we're raising capital for

Why we're crowdfunding

We decided to do crowdfunding for a couple of reasons. We wanted to give back to our crowd of loyal supporters. Without all the amazing people that trusted SleepDrops with their own sleeping challenges we wouldn’t even be here. As a small NZ company with a big heart and even bigger ambitions we wanted to offer it to our supporters for them to come along on our journey to help the world get to sleep. We want our new shareholders to love the products as much as our customers and we do and be part of growing it by being proud owners and ambassadors of the brand and by telling their friends and family at dinner parties that they should be going to bed earlier and using SleepDrops!

Investing in a great New Zealand health company should not be only for those with deep pockets. We have decided to go with “crowdfunding” to open up the opportunity to everyone. The nice thing about crowdfunding is that it makes it accessible to people who are usually unable to invest or cautious of the complicated stock market.

New Zealanders are a great bunch of people, pioneers and trailblazers. We all have friends and family in big and small corners of the globe and we knew that our crowd would help us with our global domination plan by sharing their good news of becoming shareholders in such a cool NZ company thereby spreading the word.

If you buy shares in Sleep Support System, you are buying shares in SleepDrops.

Sleep Support System Limited is offering up to 2,000,000 shares at $1.00 per share to raise up to $2,000,000. The new shares are being issued and the capital is being raised to fund the company’s growth plans. No current shareholder is selling any shares as part of this offer. The minimum subscription level for any investor is 500 shares, or a minimum investment of $500.00. The minimum amount of capital to be raised in this offer is $500,000. The total amount of capital that can be raised under this offer is $2,000,000.

There will be no oversubscriptions offered.

All shares are subject to the rights and restrictions contained in the Company’s constitution and in the Companies Act 1993 and issued on the basis that the shares will be subject to the drag along rights described in the Legal and Company Overview (page 46 of the IM) and the Company constitution.

Capitalisation table

Current shareholding

Taylor Made Trustee Company Limited - 86%

G & E Marsland - 8%

E & S Taylor - 5%

Kirsten Taylor* - 1%

TOTAL: 100%

Post offer shareholding (if the maximum goal is met)

Taylor Made Trustee Company Limited - 71.67%

G & E Marsland - 6.67%

E & S Taylor - 4.17%

Kirsten Taylor* - 0.83%

New shareholders - 16.67%

TOTAL: 100%

* These shares are held in trust for a third party.

Read our Information Memorandum for more information about our share offer

Our Financials

SleepDrops International Limited (SDIL) will formally begin trading once the equity crowdfund is complete. Until that time SDIL had no trading history. The issuer, Sleep Support System Limited (SSSL), is a non-trading entity and holds 100% of the shares for SDIL. In order to show actual trading history we have shared the balance sheet of New Zealand Health Shop Limited (NZHS), the company that was trading as SleepDrops.

NZHS resigned as licence holder for SleepDrops on the 3rd November 2018, and SDIL will start trading on the date the offer completes. The licence is perpetual, worldwide and exclusive, and can be terminated only in specific instances. SDIL needs to purchase the assets of NZHS, which will be done at book value ($210,914 as at 30 November 2018). There is an agreement between NZHS and SleepDrops confirming this sale and that it will be completed by January 2019 if the equity campaign is successful. There are no other fees or expenses associated with this transaction. This will be financed by way of an interest-free loan from NZHS to SDIL, which is only repayable when SDIL is able to make repayment from its future revenue, not from funds raised through this equity crowdfund.

Our Team

Rufus Chan

International Business Manager (Operations)

Rufus has had a love affair with numbers all his life. He has a background in business having grown up in a family business environment and, since he was 17, shadowing executives and corporate leaders to learn the ropes. Rufus analyses SleepDrops’ operations and manages its supply chain making sure all the different ingredients, components, labels and packaging come in on time and get made into the important products we sell.

Valentin Ponyaev

IT Manager

Our Web Developer, E-Commerce Specialist, IT Manager and Engineer at SleepDrops. Before starting at SleepDrops, Valentin spent 10 years leading a New Zealand plastics manufacturing company where he was in charge of designing and implementing new tools and machinery. After a successful career in manufacturing Valentin felt that it was time for a change. He then spent the next 3 years learning best web developing practices from the top developers in New Zealand and around the world. Now at SleepDrops he has the opportunity to utilise his entire skill set from designing to building, from concept to live.

Paige Cowley

Naturopathic Sleep Specialist

Paige is one of our dedicated Naturopathic Sleep Specialists, here to help all of our customers achieve their best sleep. With over 8 years’ experience in the health industry, first as a nurse and now as a naturopath, Paige has dedicated herself to learning, understanding and educating on the best way to empower health and wellbeing through the life stages. She is passionate about helping people achieve their health goals and believes that poor sleep is often a major block to healing.

Mia Yang

China Marketing Coordinator

Mia studied international business in London England. Once back in China, Mia worked at the Agricultural Bank of China (one of the 4 biggest banks in China) as an account manager of corporations. She came to New Zealand after to continue her career in the finance section working as customer service manager of commercial accounts at IE Financial Services Limited. In her personal time she worked as a “Daigou” which is where Chinese people act as personal shoppers for their friends and family in China. This has given Mia strong skills and experience needed for SleepDrops to build this very important channel as first entry step into the Chinese market.

Denny Lee

Graphics Designer, Marketing Coordinator

Denny has been in the marketing and graphic design sector for the last 10 years and is passionate about creative graphic design and marketing co-ordinating. He is a fully qualified graphic designer with a Bachelor of Computer Graphic Design and a Bachelor of Art and Design. Denny has been influenced in art and design by his mum who is an artist and an art teacher. He is super passionate about expressing and delivering super -cool designs at SleepDrops every day to communicate how important sleep is to people and to inspire people to prioritise their sleep.

Paul Kung

Warehouse Manager

Paul was born in Hong Kong and has been living in New Zealand for 24 years. He has an engineering background and had extensive management experience in multisite operations. He is also equipped with years of experience in the logistics of the pharmaceuticals and cosmetic manufacturing industry. Heaving previously supervised at independent labs we contracted our work to, and now we are very fortunate indeed to have Paul’s level of expertise here every day at SleepDrops.

Our Governance and Advisory

Kirsten Taylor

Founder and Managing Director

Kirsten is passionate about sleep, getting people to sleep, improving sleep and making super cool sleep formulations that make people’s lives better. Kirsten wasn’t always such a sleep enthusiast but after being in her Naturopathic clinic for 7 years she couldn’t deny the irrefutable evidence that not sleeping impacts on every single body system. We all know that now because the science has caught up and everyone is going on about it – which is a very good thing. Discovering that sleep is so important, early on and focussing on it so that she could positively impact every aspect of people’s lives driven her to keep going. Kirsten LOVE’s helping people be healthier and happier. She is determined to take SleepDrops to the world so we can help as many people as possible sleep better.

Prudence Murray

Sleep Scientist - Advisor

I began my career in the field of physiology in 1999, and have since had the privilege to work within public, private, and industry facets of the sleep health industry, both in New Zealand, and within the international community. During this time my focus has shifted from a purely clinical interest to a passion for delivering great health care, and promoting wellness, both in healthy populations, and those with aspirations for improved health and function. Developing services, processes, and innovative measures to not just meet, but exceed these goals is what I thrive on! I’m keen to adopt and develop new technologies as vehicles to meet such objectives, love problem solving and thinking outside the square, and thoroughly enjoy leading teams to success on these fronts. I aspire to work with like-minded individuals and organisations, both in New Zealand, and on the global stage.

Michael Durbin

Independent Advisor

Mike Durbin is a General Manager at Manuka Health New Zealand Ltd with responsibility for International sales and marketing. Prior to joining Manuka Health, Mike held a range of strategic business development, sales and marketing positions in Natural Health, FMCG, biotechnology, healthcare arenas. Notable is his five years as National Business Development Manager for Goodman Fielder, where he directed sales and marketing efforts in the Route Food Service Channel. Mike holds a Bachelors’ degree in Microbiology and a PhD from Heriot Watt University in Edinburgh, Scotland. Mike’s greatest strengths are his creativity, drive and leadership. He thrives on challenges, particularly those that expand the company’s reach.

Nitin Patel

Pharmacy and Health Channel Advisor

Nitin is a Director and experienced distribution business manager at ANZ pharma, SleepDrops pharmacy and health channel partner. Nitin has a strong honest personality making it easy for him to build solid relationships in the natural health and pharmacy channels of New Zealand. Nitin is very good at data analysis which helps to drive company strategy and decision making. Nitin and his team act in the capacity of the SleepDrops Key Account Manager with the responsibility for managing the SleepDrops brand in Pharmacy, Natural Health and Wholesaler Accounts. Nitin has experience in driving business for both ANZ Pharma and SleepDrops in Natural Health, Pharmacy and FMCG with a strong background in sales within New Zealand, Australia and other key markets. Nitin’s greatest strengths are his patience, honesty, straight up “lets fix it” attitude, an open door – open book policy and his passion for helping others both at work and in his personal life. He strives to always create win/win sales strategies to deliver immediate results and foster long term business growth for all stakeholders.

Brett Tibbotts

FMCG Advisor - CEO - House of Fine Foods

Brett and his family have been dedicated to the FMCG industry in New Zealand with Brett alone working in the industry for over 21 years. His company House of Fine Foods works with 15 global brands including AFT Pharmaceuticals, Nandos Sauces and Haribo. House of Fine Foods distribute to 426 retailers.

Robin Chang

FMCG Advisor - General Manager at House of Fine Foods

Implicit within this, is his proven ability to actively set and drive strategies and activation in line with the commercial and category plan, with a firm handle on owning and delivering financial results . His superior cross-functional knowledge and strong understanding of the impact on the wider business, means that he can offer a business-wide and a more strategic view of growth opportunities. His skills further extend to business negotiation, strategic account development and senior customer engagement.Robin operates with a high level of authenticity and integrity within all business and customer interactions, and is a personable and effective communicator. His core value in managing, coaching and developing people results in high-performing & highly engaged teams that are able to grow brands, business and relationships.

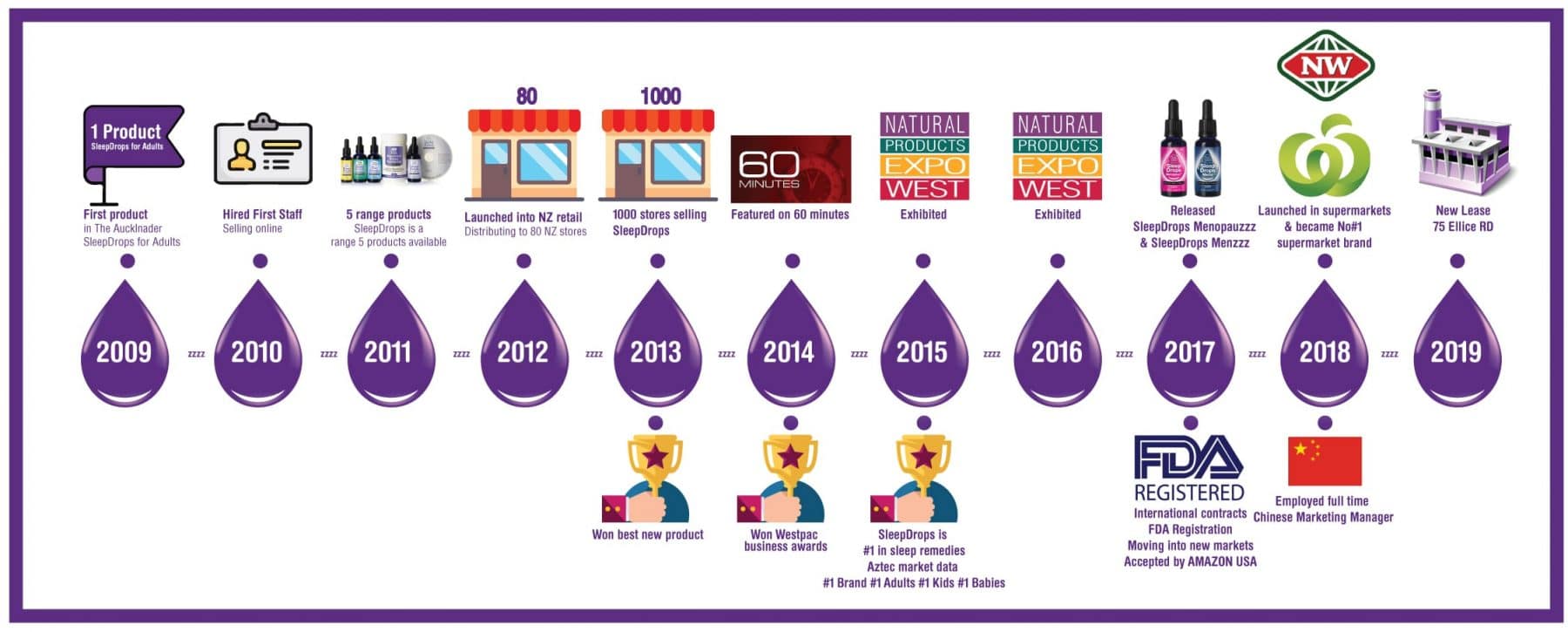

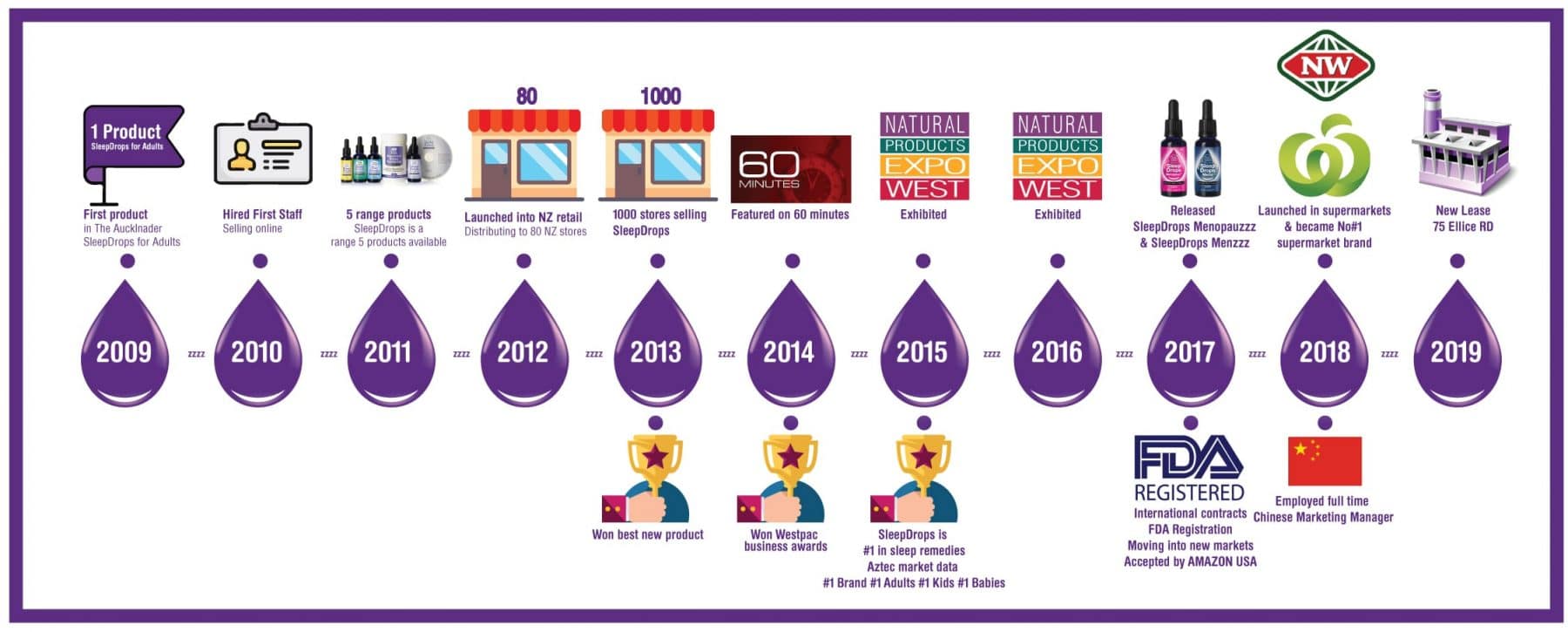

What we've done so far

Kirsten Taylor began developing her own protocol prescribing sleep support remedies in her private naturopathic medicine clinic in 2003. Due to the results her sleep protocol achieved for her clients, Kirsten made them available to the public in 2009 with the launch of SleepDrops for Adults. Since then Kirsten has launched Daytime Revive, Essential Sleep and Stress Nutrients, Delta Sleep CD (now a free download), SleepDrops Menopauzzz, SleepDrops Menzzz, SleepDrops for Kids and SleepDrops for Babies to cater for the growing demand from different customers in the sleep and stress wellness markets. For the first three years, the business operated a direct-to-consumer approach in order to ascertain whether Kirsten could successfully take a naturopathic prescription product and protocol and make it commercially viable on a larger scale.

An overwhelmingly positive response to the products, a high rate of repeat customers and growing demand from retail stores seeking to stock it, led to SleepDrops being made available in retail stores from November 2012 via a national distributor. In just nine months, SleepDrops was available for sale in over 750 pharmacies and health food stores nationwide. SleepDrops is now found in over 1,100 stores nationwide and has been the number one brand in the sleep category for the last six consecutive years. Three products from the SleepDrops range are consistently number one in their sub-categories. SleepDrops for Adults is the number one selling sleep product in NZ, along with SleepDrops for Kids, SleepDrops for Babies and SleepDrops Menopauzzz.

We have successfully registered SleepDrops with the FDA, secured ourselves a partner to act as our legal entity and opened our own brand pages on Amazon.com in the USA. We have a distribution partner in Singapore and started selling into Hong Kong and Kuwait where we are particularly proud to be able to help the children in a war zone sleep better.

We have expanded our range in NZ from three sleep liquids to 5 specific formulations and then in March of 2018 we launched our new 25 ml family spray range into NZ supermarkets after being “core ranged” across all 3 major supermarket brands: New World, PakNSave and Countdown. That’s when their head office category managers instruct that they will be on the shelves.

Our Supermarket 25ml Family Value Spray range offers our award winning and popular liquid remedies in a convenient spray form for ease of use, day and night time and is specifically targeted at our high use families. By ticking all the boxes of location, price, and application we believe this range meets the needs of our consumers who are time poor, on a budget and struggling with themselves or a loved family member not being able to sleep.

Next to come is the launch of our Practitioner Range and our Home Sleep Luxury Collection...

SleepDrops’ practitioner only range:

With Kirsten’s background as a technical consultant Naturopath to one of NZ’s largest practitioner wholesalers, she gained market insight into this often overlooked channel. With up to 3000 practitioners in NZ seeing between 5 and 60 people a day, these trusted health advisors can act as gatekeepers or ambassadors by opening up more SleepDrops’ customers when prescribing our specialised range to their patients. The formulae are more sophisticated and require a consultation but maintain our company modus operandi of combining products in synergy to create a programme for the individual. We will be doing more research on this product range in the near future. Launch of this range will happen in November 2018.

SleepDrops Home Sleep Luxury Collection:

The sleep specialists at SleepDrops are very happy to introduce a touch of luxury into your nightly wind down routine. A beautiful range of products formulated with the highest quality ingredients specifically for you to ritualise, pause, savour and enjoy the experience for enhanced relaxation. Our Original and Lavender Magnesium Bath Salts offer your body a chance to unwind and soak in a comforting warm bath with relaxation minerals, to soothe weary muscles and refresh the mind, whilst our ‘Divine Sleep’ aromatherapy room and pillow spray is the perfect combination of organic essential oils to create a haven in your bedroom, infusing your space with calm, peace and tranquillity. The luxurious sleep eye masks are made from the highest 100% mulberry silk. Delicate on your skin, this sleep mask offers a simple and effective way to support sleep quality. Our Home Luxury Sleep Collection is an opportunity to find rest and relaxation in preparation to winding down for sleep and to experience luxury at home when and as you like – you deserve it.

What's next?

Our strategic growth plan

With all the domino’s we have lined up and our anticipated growth we knew we needed to prepare for expansion. Back in April of 2018 we started looking for a larger home for SleepDrops. We are working on an agreement for a wonderful new building in Ellice Road in Glenfield. The new building is 5 times bigger than our current location. By securing a long-term home we can invest in a new factory which will increase our output by a minimum of 10 times. Manufacturing control is essential to our ability to control our growth. We aim to also protect and grow our future by working towards and gaining GMP (Good Manufacturing Practice) and TGA (Therapeutic Goods Administration) (If applicable) approval: manufacturing standards required by specific markets. We can seek new revenue opportunities each time we have ironed out the creases and got a manufacturing standard and market supply working well. Slow and steady wins the race!

In the next 5 years

NZ Market

We believe we should concentrate on maintaining the NZ Markets. We believe there is another 15% to be gained from this market. We will be bringing the practitioner range and the Home Sleep Luxury Collection to the NZ public and solidifying our reputation as the trusted sleep advisors both in retail and in the health and safety world. We will be hosting the first ever Integrative Sleep Symposium and have secured NZ’s top sleep scientists, researchers, pharmacists and international experts to speak. We are planning for this event to take place yearly around World Sleep Day in March.

Australia

SleepDrops International has been actively investigating the launching into the Australian market since 2017. The first step in launching is to register the range as a medicinal product by the TGA under the Therapeutic Drugs Act. We have determined that the Practitioner Only market is the best market entry point for SleepDrops into Australia. We believe this will be a good healthy revenue stream for SleepDrops. The product formulations are nearly finalised. We have worked with a registered TGA consultant to ensure our products to meet the requirements of the Australian TGA.

Our in-house team has been able to do most of the work needed. As such we don’t need to over -invest to get to the next level of having our products registered. $30,000 has been allocated from capital raising to fund the final steps for proceeding with an application for registration in Australia.

We have already begun microbial testing and will begin clinical research (brain waves ) in the new year with our sleep scientist over seeing this important research. Once this is completed we will be one of the only natural health companies to have undertaken such important work. This scientifically conclusive evidence will certainly help us in gaining the favour of medical practitioners here, in Australia and further around the world.

China

The Chinese government has spent the last 2 years investigating the sleep habits of Chinese people and in May 2018 they released a documentary called ‘Chasing Sleep’. The survey results show approximately 450 million Chinese people have a sleep disorder.

In 2013 the Chinese sleep index showed people were sleeping 8.2 hours, whereas now, it’s only between 5.5 and 6.5 hours. In June 2018, SleepDrops hired our first Chinese Marketing Co-ordinator. We know the Chinese Community has extra pressures (ageing population, urbanised workforce, long business hours, academic pressure, extracurricular activities, family and cultural pressures, not prioritising sleep) and want to make sure we are taking care of them properly. We will be developing specific products for the Chinese market which address their particular needs. We see opportunities in different demographics of the market:

- Geriatric

- Adult

- Adolescent – Study Market

- Children

- Babies

Plus sleep luxury accessories:

- Room & pillow spray

- Epsom salts

- Herbal teas

- Anti-bacterial dust mite pillow slip, bedding

We are in dialogue with significant market leaders in China to further our relationship and make SleepDrops a major brand in the largest market in the world. There is a clear strategy for this and once our agreement is in place the most significant revenues should begin to come in during the 2nd half of the 3rd year, – late 2021.

U.S.A

$80,000 from the capital raising will be allocated to driving U.S. sales of SleepDrops on Amazon.com and via Facebook in early 2019. Inventory for the launch has already been shipped to the United States, thus the funds will be used primarily for launch activities and promotion. We are working with US consultants to be in a position of control and managing our own agency for the US market. This is very close to being completed.

In addition, SleepDrops’ own US based website, SleepDrops.com, will be updated and go live in early 2019 offering direct sales outside of Amazon.com, Facebook and custom made landing pages to assist in building sales, and driving brand awareness of the SleepDrops range in the United States.

The United States is a very large market for sleep products, accounting for some 65% of all global consumer spending on sleep products in 2014. This share is likely to be maintained with many US publications reporting strong growth in several sleep product areas, including over the counter, natural and medicinal products.

SleepDrops International intends to manage its growth steadily in the United States via direct or internet channels and to not ‘rush to mass market’ via retail stores or outgrow its ability to service its U.S. based customers. We have a very clear strategy and have formulated products specifically for this market.

Risks and Challenges

All businesses face risks and as we plan to be a market leader we anticipate that there will be threats and attacks from other entities who wish to hinder our progress. At SleepDrops we already engage with risk analysis professionals. We look at all aspects of our business to see where we can mitigate risk. We prefer this proactive approach rather than being reactive though should we ever need to be reactive we shall react with clear and concise precision. The following swot analysis summarises what we believe our biggest risks to be.

We have summarised some of our company and investor risks below, along with our mitigation strategy.

Competition - International

Drive the brand locally to keep it strong. Focus on unique selling proposition, communicate NZ Inc, NZ Story, focus on clean and green, ensure quality control and high quality ingredients to meet product requirements for efficacious product. Hire PR company and leverage media spend in target market.

Competition - Copycat

Maintain our USP, maintain strong relationships with brand partners, maintain media relationships to maximise media spend, focus on our core message.

Regulation

Maintain professional memberships with associations so we are kept abreast of any government negotiations or anticipated changes to laws. Hire consultants to act on our behalf. Stay ahead an anticipate changes in advance. Monitor stock levels in each market. Maintain relationship with regulatory consultants. Keep FDA registration current.

Laws

Regular consultations with TAPS and ASA in NZ. Regular consultation with consultants in target markets. Partner with strategic companies that have regulatory teams in place to advise. Create an approved statement registry for each market.

Intra group license not being renewed

It is possible for the IP licence to not be renewed. However, the IP is owned by a company held for the benefit of shareholders in SSSL so SSSL shareholders ultimately control what SDIP does.

Trust arrangements being terminated

The Trust under which the shares in SDIP are held can be terminated only by vesting the SDIP shares in the SSSL shareholders. They cannot legally be taken away from the SSSL shareholders.

Closely held governance structure

Kirsten Taylor is the sole director of SSSL and the other companies in the group. However, she is subject to the duties of good faith owed by all directors and the requirements of the Companies Act 1993. She also draws on a number of advisors identified in the IM for support and guidance on governance and other matters. They will look to add more people to the board in future.

Related party transactions

Related party transactions are constrained by the duties of good faith owed by all directors and the requirements of the Companies Act 1993.

Thank you

It’s my absolute pleasure to offer you this opportunity to join the SleepDrops family officially by becoming an owner of this cool little company with BIG dreams. Today I ask you to help me to help more people, with SleepDrops, not just in New Zealand but all around the world. I sincerely thank you in advance for your support. You have my word that myself and my team will work very hard – Thank you again.

THANK YOU SO MUCH FOR YOUR INTEREST IN HELPING US TO HELP PEOPLE SLEEP BETTER AND LEAD HAPPIER HEALTHIER LIVES

Note from PledgeMe

We have completed a Veda check on the company and their directors, as well as a google check. There were no adverse findings.

Updates 8

Sleep Support System Limited - campaign open again!

20/12/2018 at 1:45 PM

We are giving investors the opportunity to withdraw their pledge. If you would like to do so, please email [email protected] by 5pm on Friday, 28 December 2018.

Hello everybody,

The Sleep Support System Limited (trading as SleepDrops) campaign is now open again. As you know our campaign was put on hold due to some queries which were raised with PledgeMe and the Financial Markets Authority.

We were happy to co-operate and be as helpful as possible to clear up any and all queries.

We have had an independent accountant check our numbers including our forecasts and our balance sheets, we have worked with our lawyers to provide the updates below, we have added “layman’s” comments for those that are bewildered by legal jargon and we have updated several parts of our IM to clarify further. In the interest of continued transparency all the points raised with us are summarised and discussed below (and in our updated IM here). The legal clarifications are also provided for your reference.

The basis of the offer to you is the same. We believe our products are still great, the opportunity for SleepDrops is still massive, the sleep market worldwide is still booming.

We have responded to every question. We are standing strong. SleepDrops is committed to working hard and making this a wonderful investment opportunity for everyone.

We are very sorry for the delay and the worry this may have caused any of you. Believe me when I say it has been worrying for us too but we believed we would prevail! And we have.

Please support us by investing in SleepDrops today. The campaign will only be open for another week as we need to get busy with the contracts we are working on for China and the US markets.

Let’s do this!

Kirsten and all the team at SleepDrops

We were asked to clarify

- Our forecasts - We were asked to justify our forecasts – all done. An independent lawyer and accountant looked over the numbers and assumptions.

- Our IP structure - We were asked to explain why the IP sits out separately from the main shareholding company. We provided our Declaration of Trust that shows Sleep Support System Limited is the beneficial owner of the sole share in Sleep Drops IP Limited. We’ve provided more information on page 4 of the IM and below.

- Our licence agreement – we were asked to clarify the licencing agreements in place. We provided copies of our licencing agreement and amendments that show New Zealand Health Shop has resigned as licence holder and that Sleep Drops International Limited has an exclusive, perpetual and worldwide licence paying 2% of Net Profit to Kirsten Taylor and 3% of Gross Sales to Sleep Drops IP Limited (beneficially owned by Sleep Support System Limited). We’ve provided more information on page 2 of the IM and below.

- Our new home - We were asked to confirm that no money from the campaign would be used to buy the new building. This is the case, but the building will probably be owned by a related party. We’ve provided more information on page 4 of the IM and below.

- Our financials - We were asked if the financial information provided was for Sleep Support System Limited. It was in fact a mix of historic trading for New Zealand Health Shop Limited and forecasts for Sleep Drops International Limited (the 100% owned subsidiary of Sleep Support System Limited). We’ve provided more information on page 2 of the IM and below.

- Our risks - we’ve added some more specific risks for the company and investors on page 44 of the IM.

- The valuation – has been set to $10million pre-money in line with the number of shares issued.

- Rights attached to non-voting shares – the instances where a non-voting shareholder could vote have been revised (page 35)

- Our community page - a concern was lodged with the Advertising Standards Authority. It was alleged that SleepDrops was “fooling people into investing” by saying our products are highly effective when they are not registered medicines. We have addressed this concern by removing that wording from our IM and we have also removed all positive feedback and testimonials including the entire “Our Community” page from our IM document.

Financial information for SleepDrops

SleepDrops International Limited (SDIL) will formally begin trading once the equity crowdfund is complete. Until that time SleepDrops International had no trading history. It was also explained that the issuer, Sleep Support System Limited (SSSL), is a non-trading entity and holds 100% of the shares for SDIL. As such no historical financial information was provided for those two entities. It was decided that in order to show actual trading history it was best to share the balance sheet of New Zealand Health Shop Limited (NZHS), the company that was trading as SleepDrops. We have created balance sheets for all three entities, provided on page 3 of the IM.

The profit & loss information provided on the SleepDrops campaign page was a combination of historic NZHS information and forecasted financial information for SDIL (noting FY2019 is a combination of NZHS and SDIL).

The NZHS balance sheet from June 2018 initially included a suspense account of $250,000. This was removed, as it belongs to another entity. See our updated balance sheet page 38 of the IM.

NZHS resigned as licence holder for SleepDrops on the 3rd November 2018, and SDIL will start trading on the date the offer completes. The licence is perpetual, worldwide and exclusive, and can be terminated only in specific instances. SDIL still needs to purchase the assets of NZHS, which will be done at book value ($210,914 as at 30 November 2018). There is an agreement between NZHS and SleepDrops confirming this sale and that it will be completed by January 2019 if the equity campaign is successful and there are no other fees or expenses associated with this transaction. This will be financed by way of an interest free loan from NZHS to SDIL, which is only repayable when SDIL is able to make repayment from its future revenue, not from funds raised through this equity crowdfund.

Comments from SleepDrops Lawyer:

SSSL has not yet traded and has no financial information to disclose. No forecasts are provided in relation to SSSL. It could receive dividends from SDIL in due course and will pay dividends as and when surplus funds are available.

SDIL holds a licence to the SleepDrops IP but otherwise does not trade and has no financial information to disclose. All trading activity has been undertaken by NZHS trading as SleepDrops. The historic trading is set out in the Financials on page 38 of the IM. Following the capital raising the licence to NZHS will terminate and SDIL will trade directly. SDIL will buy the fixtures and fittings and stock in trade used in the SD business at book value. This will not be paid for by any money raised from the crowdfund and if any payments are required they will be paid for through revenues generated. The forecasts in the Financials on page 38 of the IM are the forecasts for ongoing trading by SDIL (noting FY2019 will be a mix of NZHS and SDIL trading).

As stated on pages 46 and 47 of the IM, NZHS has been trading exclusively as SleepDrops since 2012. As such the historical financials provided are in the name of NZHS

Kirsten’s explanation:

We have informed our investors that we plan on re-investing all revenues into SDIL for the first 2 years because we are anticipating strong growth and believe we will need the money. After that, once the board decides it is in the best interests of the shareholders we will aim to pay out some portion of dividends to SSSL. As such there are financials provided for SSSL, but as it is non-trading it reflects as a zero balance. SSSL as it is a non trading entity which only holds the SDIL shares.

Until the crowdfund capital raise is complete SDIL will also have a zero balance as it has not traded. It will only begin trading once the PledgeMe offer is completed. At that time it will take over trading and all business to do with SleepDrops.

In the IM I made reference to the SleepDrops products being invented when I was a Naturopath (page 7) and all financials were filed under the umbrella company NZHS (my previous naturopathic clinic company) referred to on page 46 and stated that SDIL has not started trading. The relationship between NZHS and SDIL was explained in chart form (page 47) and in words (page 46 and page 47) in the Information Memorandum.

Once the crowd funding capital raise was finalised (which was to be on December 3rd), NZHS was to cease to operate SleepDrops business. Documents are in place which terminates the relationship between the two companies

Who owns the IP?

SleepDrops International has the exclusive international rights to manage all SleepDrops IP on a day to day basis.

Comments from SleepDrops Lawyer:

The IP is owned by SleepDrops IP Limited (SDIPL). The share in SDIPL is held for the benefit of the shareholders in SSSL, as outlined in a Declaration of Trust signed 25 October 2013. The Declaration of Trust confirms Taylormade Trustee Company Limited (TTCL) holds the one share issued in SDIPL in trust for the shareholders of the issuer, SSSL. This structure was put in place to insulate the IP which is the group’s most valuable asset and shareholders’ interest in that IP from potential claims on SDIL and SSSL. It is documented in a way that any dividends, interest, or sale would be paid out to SSSL as the beneficial owner of the sole share in SDIPL. Refer to pages 45 and 46 of the IM.

Kirsten’s explanation:

All the IP for SleepDrops is owned by a separate company, SleepDrops IP Limited, but the beneficial owner is SSSL. It was determined that it was safer for the IP to be separate from the trading company and the shareholding company. This was done for 2 reasons. One, if someone took one of my products and had an adverse reaction they could take legal action against SDIPL and not SSSL. The main point being = they could only come after me! Two, they could also potentially sue the manufacturing company (SleepDrops International) but again not Sleep Support System Limited.

I am doing my best to protect the shareholders. There is documentation in place that states the IP is held in trust for the benefit of the shareholders.

Building ownership

No money from the SSSL capital raise will be going towards purchasing the new building.

Comments from SleepDrops Lawyer:

A deposit has been paid by NZHS. The building has not yet been fully purchased. The final entity or who will own the building has not been decided, but as it will be some entity involving Kirsten Taylor, it is considered a related party of SSSL. The lease terms will be determined once the sale is finalised. The monthly rental has yet to be decided but will be sufficient to cover the building mortgage and outgoings.

Kirsten’s explanation:

We are aiming to secure the building as a new long-term home for SleepDrops International so we can build a factory to meet the demand we will be creating, without fear of being evicted.

Reviewing feedback

15/12/2018 at 12:12 PM

Dear investors (and potential investors),

As you know, we were asked to send through more information on our campaign and company to the FMA and PledgeMe (including contracts, trust deeds etc).

We've just had a response, and we're working through the feedback from the review of our updated information now. We're aiming to get a full update out to you next week.

Diamonds and other beautiful things are made from high pressure so hang in there with us, please.

Thanks again for your support to date.

Kirsten and the SleepDrops team

PledgeMe SleepDrops update

10/12/2018 at 4:04 PM

Updated information coming

04/12/2018 at 12:08 PM

Just a quick note to tell you that Sleep Support System Limited are updating some of the campaign information to address some questions that have come through. We are committed to ensure there is no confusion on any aspect of the campaign.

We are working on this at the moment. PledgeMe will not start verifying identities or processing funds that have been pledged during the campaign until this additional information is provided to all pledgers. If you have transferred your funds already, they will be held in trust by PledgeMe until you have had the opportunity to consider the additional information which will be provided to you in the next few days.

Thanks for supporting the SleepDrops vision.

Kind regards,

Kirsten from SleepDrops

Breaking NEWS! SleepDrops signs MoU with Major Chinese Pharmaceutical and Biotech company.

28/11/2018 at 5:44 PM

Hello investors and potential investors,

We have GREAT news!

We are very excited to announce have signed an MoU with a fantastic partner in China!

We believe this is a significant step towards furthering our sales in China, both cross boarder and on the ground through physical stores and registration with the CFDA in China.

This partner has an experienced team and can support us in many aspects of our business.

We have done our due diligence and interviewed other NZ companies that they are already working with them. They had nothing but good things to say about them.

We would like to take this moment to thank Natural Products NZ and New Zealand Trade and Enterprise and the Chinese Chamber of Commerce for their fantastic support in facilitating introductions which lead to this development.

Our Equity Crowd Fund finishes on Monday at 6pm. NOW is the time to show your support of SleepDrops and jump on board and pledge in return for shares.

I can promise you myself and my amazing team at SleepDrops are doing ALL we can to make this a fantastic investment for all shareholders.

We are very honoured to be taking you along on this exciting entrepreneurial journey with us!

Thank you so much

Kirsten and all the team at SleepDrops

We're an open book, even when we make mistakes

21/11/2018 at 9:13 AM

It’s been an interesting week. Firstly we are super lucky to have a highly engaged crowd who are interested and reading our documents including the financials. We couldn’t be more chuffed about this as so much effort went into it all. So thank you. We have had a small number of inquiries either directly or via PledgeMe and we have sent all information needed with full explanations. We are an open book.

One financially savvy person alerted us to an error in the balance sheet which was very helpful. With all the attention given to the information we wanted to share with you about our forecasts, our plans, our strategy and our domino’s lined up, an error involving a non SleepDrops related debt sitting in the suspense account managed to slip past me, my team and the PledgeMe team making the Balance Sheet incorrect. We acknowledged the mistake and the incorrect inclusion of the suspense account. In our attempt to quickly rectify the problem, the team member responsible made the following error, incorrectly stating that the current liabilities were $184,096 instead of $206,409. We can confirm that the top level numbers for June 2018 were: Total Assets $374,772, Total Liabilities $280,032, and Total Equity of $94,740.

It goes without saying that this is a most unfortunate series of mishaps and I want to assure you it is no reflection of how we normally perform here at SleepDrops. Mostly I really want to make sure I have given it my best efforts to clean up any confusion. We have updated our IM to show the clear picture of SleepDrops financial position as at June 2018.

Here’s the thing. People make mistakes, even accountants. It’s how honest you are and how quickly you set about fixing the problem and doing what is right that matters. We have been totally transparent, willing and open to answer any and all questions. We have invested many months of man-hours on this campaign and getting the business ready for the next stage which we will all go on together. Thank you for your questions, emails, messages of support and understanding.

We have 13 days left to raise our maximum goal of $2 million! We're excited about you being a part of our journey.

Yours sincerely,

Kirsten Taylor

Mistake in the Balance Sheet - all sorted now

14/11/2018 at 12:33 PM

- Firstly I wish to apologise for causing this confusion in the first place.

- We were alerted to a potential mistake in our balance sheet

- This is a copy of the reply we sent to the cleve person who spotted it to explain why and what had happened.

Thank you for bringing this to our attention. Our chief number cruncher has been away on annual leave and I wanted to triple check with him what was the situation before finally replying. As mentioned in yesterday morning’s reply there is no worries regarding the debt to asset ratio. An item has been added to the suspense account for accounting accuracy. It is a temporary loan the BNZ has lent Kirsten Taylor to buy the new building SleepDrops International will be moving into. It is not a SleepDrops debt. Once the new building entity has been finalised, it will be removed from the accounts completely. Items are added to an organisations suspense account as a temporary allocation until they are finalised to the correct or final account.

· We have now updated the IM with the correct figures, and our financial documents

· If you have any questions, please feel free to contact us ([email protected]z) or PledgeMe ([email protected])

New Zealand natural health company SleepDrops targets Chinese sleeping problems

07/11/2018 at 11:45 AM

Introducing SleepDrops China Market Co-ordinator Mia Yang. SleepDrops founder Kirsten Taylor has a short chat to Mia about why we are targeting the Chinese market. Very recently released information from the Chinese government estimates the Chinese market potential for sleeping problems to be massive with lack of sleep affecting 50% of the entire population. With sleep deprivation causing anxiety, depression, cancer, obesity, alcohol and drug abuse, domestic violence, road accidents and other accidents causing injury and lack of productivity the Chinese government know they have a BIG problem on their hands. SleepDrops is developing market specific products and actively focussing on offering solutions to this market.

It's exciting times for SleepDrops.

Invest by pledging today to help us achieve our goals of supporting this important market.

Details

Offer Details

| Current Valuation | 10,000,000 |

| Raise Minimum | 500,000 |

| Raise Maximum | 2,000,000 |

| Share Price | 1.00 |

| Minimum Pledge | 500.00 |

| Maximum Shares Offered | 2,000,000 |

Explanation of valuation:

The valuation was undertaken by our sole director with management and professional external advice. We have also considered how the target’s fundraise could affect revenue and growth of the business. This valuation which was calculated using various conventional models to determine business value including current revenue, discounted cash flows, future prospective revenues, EBIT and NOPAT. 2018 FY actualised revenue is $1,528,332.58 and takes into consideration non-financial assets the company holds which are essential to future growth and brand protection such as trademarks.

Please note the financial information below is a mix of historic information for New Zealand Health Shop Limited, and forecast information for SleepDrops International Limited (the 100% owned subsidiary of the issuer, Sleep Support System Limited).

Financial Summary

| Prev Year | Current Year | Est. FY 2026 | Est. FY 2027 | |

|---|---|---|---|---|

| Revenue | NZ $1,528,333 | NZ $2,657,183 | NZ $14,123,333 | NZ $31,697,353 |

| Operating Expenses | NZ $1,056,948 | NZ $1,303,319 | NZ $6,141,667 | NZ $12,800,526 |

| EBITDA | NZ $179,400 | NZ $685,249 | NZ $5,209,046 | NZ $13,314,347 |

| Net Profit | NZ $140,326 | NZ $493,379 | NZ $3,750,513 | NZ $9,586,330 |

Company Details

Company Name: Sleep Support System Limited

Company Number: 3231220

Company Documents

Director Details

| Name | Role | Profile URL | Invested? |

|---|---|---|---|

| Kirsten Taylor | Founder and Managing Director | https://www.linkedin.com/in/kirsten-taylor-1561497/ | ✔ |

Questions 36

Reading email sent 17.2.2019 'if you popped some money in but reckon tou should pop some more in' does that mean I can add more to my orginal investment.

Posted on 17-02-2019 by Cameron BrownHi, the option we chose when we pledged is no longer available. Can you tell me what that means? Thanks, Jamie

Posted on 28-12-2018 by Jamie GrahamThanks for your reply.

I’m not referring to the nodsleeps ad, I’m referring to the second google ad which is for sleepdrops.

The use of ‘clinically proven’ implies a therapeutic purpose. You also say that sleepdrops is ‘super potent’

If your customers don’t want to buy medicine then why claim you are clinically proven? It implies sleepdrops is a medicine.

https://www.anza.co.nz/Section?Action=View&Section_id=53

Posted on 28-12-2018 by JamesI refer to the attached google ad

https://ibb.co/KqS897s

Specifically the use of “Clinically Proven” and “Super Potent”

Question 1) Are you saying that TAPS have reviewed and OK’d all your google ads?

Question 2) Do you realise that this is a flagrant violation of the fair trading act and can expose the company to a huge fine from the commerce commission?

3) Shouldn’t the Risks section be updated to reflect the risk of litigation if you are taking such big risks?

4) Aside from the legality. Do you not agree that promoting your remedy as a potent medicine that has been proven to help sleep is incredibly immoral?

HI James, Thank you for bringing this to our attention. I would like to politely point out that your screen shot shows it is in fact NOD Sleep.com ( our competitor) that is in violation of the medicines act in stating they are super potent and contains sedatives. We are SleepDrops not NODSleep.com, who are purposely trying to get our customers to think that they are buying SleepDrops.....it's a super drag actually. They also tell people their product is an insomnia medicine and all sorts of things that we do not. You will not find the word insomnia anywhere on our site because we know we are not allowed to use it. We work to ensure we follow TAPS and the laws of NZ. As for the SleepDrops Ad below the NODsleep.com one you have attached which is in violation We have not run google ads for some time because we have to compete with our own re-sellers which just drives up the auction price for the key words so I am not sure why this is showing as an "ad" but once we are open again in the new year I will definitely get my team to look into it. Our remedies are "clinically proven". I developed them in my clinic and tested and trialed them over several years before releasing them to the public back in 2009. And yes - back in 2009/2010 we had this wording approved by TAPS. We also regularly conduct consumer surveys and efficacy and quality control data collection to ensure our products are still working the way we want them to. We also conduct health and safety surveys with our 1100 re-sellers and check and see whether any adverse reactions have been recorded or reported in the last 12 months, in any stores and over our entire range. We just did one back in Nov/Dec and there was not one. We also work with one of NZ's leading sleep scientists who sits on our medical advisory board to collect research regarding our ingredients and we plan on doing proper sleep studies this new year. I reckon as a small company our morality is right on track. We are committed to making the best quality products we can for our customers. We don't state that they are potent or medicines because we know we are not allowed to. We are members of the professional association for our industry Natural Products NZ and do our best to keep up to date with any changing regulations or laws. As such we don't believe we are acting in a risky manner. I'd also like to mention that the Natural Health Products Bill which is based on the medicines act of 1981 is going to be amended in 2019 to accommodate some level of therapeutic claim for natural health products because its only fair that consumers be allowed to understand how natural health products work without them thinking they are a medicine. People taking natural health products are invariably doing so because they DON'T want to take a medicine. Anyway I appreciate your concerns and I hope that my comments have let you know we do abide by the law and we take all of this very seriously. Thanks James.

Answered on 27-12-2018 by Kirsten Taylor

Careful James, your last "question" reads more as an opinion (albeit a good one), and as I'm sure you already know, will be subject to removal by PledgeMe...

What are PledgeMe's rules with regard to a crowdfunder's responsibility to respond to questions in a timely and honest manner?

Posted on 30-11-2018 by MattI have never seen a set of financial statements without a company name heading. The implication is that the financial statements are for sleepdrops. Can you please confirm if they are in fact for NZ Health Shop Ltd, which I can only assume they are as my question has gone unanswered.

If they are for NZ Health Shop, then why would assets need to be bought from NZ Health Shop after the capital raise, as they are already presented as assets of the company we are buying in the IM?Are we buying the same assets twice? Are the liabilities also to be transferred?

Page 5 of the IM states the Guiding Principles:

"As close to perfect as possible. We strive for excellence in every single aspect of our business. Everything at SleepDrops is ruled by this principle. If the herb, nutritional co-factor or synergy ingredients isn't perfect and excellent on every level - it's gone!"

Do you think that you should apply those principles to your crowdfund and remove the offer while you perfect it?

Posted on 29-11-2018 by MattHi There! I was wondering if sleep drops will be registered with NZX after the pledgeme campaign? :)

I think what you're doing is amazing and thanks for being so transparent!

HI Eloise, Thank you for your question. Sorry for the delay in getting back to you but you may know our campaign was suspended pending an FMA inquiry and we were not permitted to post. Gosh Eloise we have really really tried to be transparent and fully co-operative! Its wonderful news that we have been allowed to continue which of course we had no doubt! Thanks for your message of support. Kind regards Kirsten

Answered on 20-12-2018 by Kirsten Taylor

Hi Kirsten. Congratulations on your MoU with China. That's a huge opportunity and I'm excited for your team and the shareholders. Well done! I can see you are getting slammed on here with quite honestly, in my opinion, harassing and small detail business questions. I imagine that as a small business owner you have relied on trusted advisors to help you get to this point. To draw a line under all these petty questions, can you confirm that all the information you've provided has been done in good faith? Do you get up every day to do your best to help people sleep better? Do you sincerely plan to do your best to grow SleepDrops for the benefit of insomniacs and all shareholders? You have conducted yourself with patience and grace on here. Frankly you've been more patient than most would have been. I am completely satisfied with your answers and do not require any more information from you. I just wanted to let you know the minority opinion does NOT reflect the majority. Keep going strong and good luck!

Posted on 29-11-2018 by Jonathan GeeForgive me if I’m going down the wrong path here, but what entity have you provided financials for in the IM?

I’m confused because the IM states that sleep support systems and sleepdrops international have never formally traded?

Surely you’re not providing financials for NZ Health systems, a company that pledgeme shareholders are not buying in to?

HI James, Thank you for your question. All of the financial information is explained in the updates and the IM. Kirsten

Answered on 20-12-2018 by Kirsten Taylor

Hi Kirsten,

yet again I am disappointed with your evasiveness in not answering my previous questions. The reason why you are getting asked the same questions is that you have not actually answered them! I do not think it would be fair for other would-be investors for me to get information personally and this not be shared with everyone - you are apparently an 'open book' are you not??? I would very much therefore like my previous questions answered on this forum. You are asking for $2M - surely we are entitled to some honest answers before parting with our hard earned money? Also, I see you have P&L statements for previous years - do you also have prior year balance sheets we can see? Have any of your accounts ever been externally audited - I'm guessing the most recent ones used in the IM haven't? Will they be audited in future?

Posted on 28-11-2018 by James CameronHI James, I tried very hard to answer all of your questions as accurately and as honestly as i could. I also reached out and offered you a meeting with our team, our accountants and our lawyers. We have been fully co-operative and as transparent as we possibly could. Our forecasts, assumptions, balance sheets and all manner of accounting things have been independently analysed as part of our commitment to satisfying the queries to the FMA. Today we have been allowed to continue with our offer and updated IM has been published. Crowd funding is not for everyone. If for any reason you don't feel like it meets your investment needs that's okay. Thanks James.

Answered on 20-12-2018 by Kirsten Taylor

Why have sleepdrops been running google ads saying “SleepDrops Clinically Proven” ?

Isn’t this illegal?

What % of your sales converted from these ads from people who had good reason to expect that the product was medicinal and might actually work any better than a placebo?

Or have SleepDrops been clinically proven?

HI James, The medicines act of NZ 1981 only allows registered medicines ( Pharmaceutical drugs) or medical devices to be able to make medicinal claims. The natural products industry is supported by the Therapeutic Advertising Prevetting Service known as TAPS and content by natural health product advertisers goes through this process. We deal with TAPS and the Advertising Standards Authority when we need to and take our obligations seriously. Thanks James

Answered on 20-12-2018 by Kirsten Taylor

Actually the IM states that directors (plural) determined the valuation. I guess this was a typo but I feel it is an important point because of the related party conflicts and the fact that the constitution strips shareholders of some standard protection. Eg. Director can issue any number of shares at any time to dilute pledgeme shareholders.

You say that the new premises was all explained in the IM, but I see no mention of the fact that you are the landlord. Will you update the IM to disclose this omission in the related party section?

Did you negotiate a good deal for shareholders? I managed to negotiate a 6 month rent holiday and fitout costs for our lease.

Why are you waiting until after the equity fund raising to clean up trading companies and licenses to make it ‘clean and simple’ ?

Wouldn’t it have looked better to do this before the fund raise so the public knew what they were actually buying into?

What is the balance date of the company? Ie what month does FY19 end?

Thanks

HI James, Thanks for your questions. Apologies for the delay in coming back here. As you may know the campaign was suspended pending an inquiry with the FMA and no content could be posted. Great news! We have been allowed to continue with our campaign.

The company has no intention of issuing any more shares. As a director I am bound by the good faith all directors must adhere to. To further strengthen my skills as a director I have applied to become a member of the Institute of Directors.

The reason the final entity who will own the building is not disclosed is because it hasn't been decided yet. No lease has been finalised. The good news is that once an agreement is finalised, a new building will allow SleepDrops to grow and build the factory it needs to meet the demand for products we are creating without a risk of being evicted. We have clarified this further in our updated IM. Please feel free to have a read.

Yes James it would have been better to clean everything up before the campaign went live. For several reasons this was not able to happen.

Have a read of the updated IM and with all the effort and consultation we've been through I sincerely hope this new version is clearer for you. Thanks James.

Best regards Kirsten

Answered on 20-12-2018 by Kirsten Taylor

1. Per the comment above from 'James Cameron': "The (updated) balance sheet I have (version#2) states a total equity of -$134,019 - this was provided after the first question arose about your balance sheet. I could not understand why you were saying there was only a $1000 anomaly and refuting a negative equity situation!!?? However, tonight I went back to your IM and see that it has changed again (version #3) - I don't recall seeing anything to advise a 3rd revision to this and from the questions others have also been bamboozled by this??? "

2. Kirsten, I am disappointed that, as the original person who noted the error in IM #1, the question from 'James Cameron' above cites the negative equity presented in IM #2, which I asked about below in good faith. Your response was that I was "confused" and that there was no negative equity. I was embarrassed by this, as I too had seen IM #2 and the negative numbers and took a view it was negative equity, but decided to not get further involved nor ask for clarification given your efforts to resolve it. However, your "update #3 - We're an open book, even when we make mistakes" suggests an error in IM#2 per your comments "in our attempt to quickly rectify the problem, the team member responsible made the following error..." which I read to mean IM #3 was issued afterwards with the final numbers.

My question: Why did you not just tell me/readers that the IM #2 numbers were wrong, and now updated (leading to IM #3), rather than telling me I was confused? From my position, I can only go off the numbers I am presented.

Tip of the hat to James Cameron

Posted on 27-11-2018 by Christopher WalshHi Christopher, Thanks for your ongoing interest in our campaign. I thought I had confused you, hence the comment in my response on 15 November. When we re-looked at our numbers, we realised where the confusion lay, and updated our numbers to clarify. We told our crowd of pledgers and followers on 21 November about the update, but if you have not pledged to our campaign you may not have received this email. I'm sorry if you felt embarrassed, and if you would like to discuss this in more detail please contact me direct. Kirsten

Answered on 28-11-2018 by Kirsten Taylor

Hi Kirsten,

I must say I was very excited about this opportunity when it came up and have only heard good things about your products from people I know who use them, so well done! However, I am getting very confused by all the comings and goings and would like some simple explanations for a non-accountant layman please. I was very confused by your continual reference to the $1000 accounting anomaly and dispute of the negative equity situation. The (updated) balance sheet I have (version#2) states a total equity of -$134,019 - this was provided after the first question arose about your balance sheet. I could not understand why you were saying there was only a $1000 anomaly and refuting a negative equity situation!!?? However, tonight I went back to your IM and see that it has changed again (version #3) - I don't recall seeing anything to advise a 3rd revision to this and from the questions others have also been bamboozled by this??? (Q1. Where was the notification given on this - I never saw it?) Now I can see where you reference the $1000 anomaly to total equity (compared to version #1) and it is back to +$94,740. Q2. Can you please explain where version #2 came from and now version #3. In V3, cash has increased by 228,000 and total liabilities has also increased by the same - this does not seem immaterial to me. Q3. Is this the BNZ loan to buy the building and suspense account transactions you were talking about? Sorry I don't know what a suspense account is, but if it is not a sleep drops debt then why is it on the sleep drops balance sheet (layman's terms please)???

I can't help but agree with (other) James in that all the value appears to be in the Sleepdrops IP company and that we are just buying a trading company licensed to sell sleepdrops and that his proposed structure would be much more equitable for us minority investors. Q4 can you expand further on this (in layman's terms?) Q5. Is there anything stopping sleepdrops IP ltd from licensing sleepdrops to other trading companies? Q6 is there anything stopping someone from buying sleepdrops IP ltd from you and cancelling the license to sleepdrops international ltd? You stated "If some large company wants to acquire SleepDrops EVERYONE would benefit from the sale." Q7 can you please explain exactly what it is they would be buying and how everyone would benefit? You've been asked 2 -3 times now about the payment made from SleepDrops to NZ Health Shop. "This amount is not expected to be significant". Q8 how much roughly is 'not expected to be significant' - i think as potential shareholders we are entitled to all information, but you so far side-stepped this question multiple times? I also have a bone about the 2% license fee - Q9. If you are retaining 86% ownership of sleep support systems (incl. 86% of any future capital growth + dividends) + 100% of the IP company + I imagine a generous annual salary (are you at liberty to disclose this?), then why do you need 2% of net profits on top? I'd appreciate you numbering all questions and answering them individually as I don't feel previous questions have been answered entirely satisfactorily and some appear to have been totally ignored. Many thanks in advance.

HI James, I can assure you i have tried very hard to answer all of the questions put on here. We are running a company and for the benefit of all of our shareholders I can't physically continue to answering the same questions over and over. I too am just a lay person. Perhaps a more indepth meeting with our lawyers and accountants would satisfy? Would you like to make a time with me to meet in person? We have just signed a memorandum of understanding with a major chinese pharma and biotech company with the help of NZTE and Natural products NZ. I'd love to have a chat with you about all of this. Let me know when suits you. Kirsten

Answered on 28-11-2018 by Kirsten Taylor

The IM refers to directors (plural) although I can only see Kirsten listed on the companies office. Can you please confirm who the other directors will be and whether there will be an independent director?

There was no mention of who the new landlord will be in the related party section although I note in the updates about the balance sheet error that the implication is that Kirsten will be the new landlord. If this is the case then will the other directors negotiate the lease?

Question 1 regarding directors. At the time of the launch of the PledgeMe campaign and the publishing of our I.M, Kirsten Taylor is the only director as listed on the companies office. The I.M states this and shows our advisory board of experienced people that we work with. We are in the middle of putting together a clever board of people who will bring skills and expertise that will help SleepDrops move forward. We do have an update coming soon about a new person we have just signed on. Watch this space!

Question 2 regarding the landlord of the new building which SleepDrops will be moving into in the new year. The separate entity is being arranged upon recommendation of the bank who have advised that this was good practice. At this time a successful equity crowd fund is our main priority. Once this is completed all shareholders will be regularly communicated with to keep them in the loop. Thanks James.

Answered on 27-11-2018 by Kirsten Taylor

I still don’t understand the IP ownership sorry. If we are buying shares in a holding company that owns the IP, then who are we paying a license fee to? Why would we have to pay a license fee for IP that we own?

Posted on 27-11-2018 by JamesThere are all sorts of ways to own and license intellectual property in the business world. Whilst we appreciate your opinion as to how the group could be structured but we have been guided by our lawyers on this matter. Thanks James

Answered on 27-11-2018 by Kirsten Taylor

Thanks for the answer re shares Kirsten.

So for clarity, you will be issuing an additional 86994 shares to existing shareholders prior to the issue of 2m shares to PledgeMe shareholders? Ie. you won’t be issuing 20% of the company’s shares to PledgeMe shareholders, you will be issuing approximately 20%.

HI James, Thanks for your question. Apologies for the delay in coming back here. As you may know the campaign was suspended pending an inquiry with the FMA and no content could be posted. Great news! We have been allowed to continue with our campaign. To answer your question - it is my understanding that now the share values have been tidied up to match the company value we won't need to worry about that. Please have a read through our update section and our updated IM. Thanks so much James Kirsten

Answered on 20-12-2018 by Kirsten Taylor

Hi there,

I’m not sure the response provided by PledgeMe regarding your cap table is quite right.

The business today has 10,000,000 shares according to the Companies Office. This is the pre-money number of shares (i.e. before any money is raised and before any new shares are issued), so, using their example, you own 86% today which equals 8,600,000 shares (https://app.companiesoffice.govt.nz/companies/app/ui/pages/companies/3231220/shareholdings)

So if, per James’ comment, 2,000,000 new shares are issued from this raise these shares will represent a shareholding of 16.67%, being 2/12... I think PledgeMe's response misrepresents either the share price or the number of shares being raised.

It should either be:

- $2,000,000 raised at $1.0086994/share (i.e. $10,086,994 pre-money valuation divided by 10,000,000 shares) which would then result in 1,982,751 new shares being issued (not 2,000,000) to give the 16.55%; or

- if you're raising $2,000,000 at $1.00/share (i.e. a discount to your pre-money valuation), then it'll be 2,000,000 new shares over a total of 12,000,000 shares after the raise to give 16.67%

....which is it?

Posted on 26-11-2018 by MattHI Matt, Thanks for your question. Apologies for the delay in coming back here. As you may know the campaign was suspended pending an inquiry with the FMA and no content could be posted. Great news! We have been allowed to continue with our campaign. So now to answer your question in regards to the share values etc. The share amounts have all been tidied up to match the amount of the valuation which means that if we raise our full amount of $2 million it will be 16.67% This is all explained in more detail in the updated IM. Please feel free to have a read through. Thanks so much Kirsten

Answered on 20-12-2018 by Kirsten Taylor

Thanks for your answers regarding IP Kirsten. I understand why Staples Rodway suggested you create a holding company for the Intellectual Property. Good advice at the time.

However, now you are getting more shareholders on board I don’t believe it is appropriate. The PledgeMe shareholders are not actually buying SleepDrops at all. They are buying in to a trading company with a license to sell Sleepdrops. All of the value is in the IP company that your trust owns. If some large company wanted to acquire SleepDrops one day they would acquire the IP company owned by your trust. PledgeMe shareholders wouldn’t receive anything.

I believe a more appropriate structure would be to have the trading company wholly owned by the IP company and to issue shares in the IP company.

I don’t believe this IM has enough information in it for someone to make an informed investment decision. Without seeing a copy of the license agreement, it is impossible to know if Sleep support systems has any value.

I don’t think the average PledgeMe investor would realise that they aren’t actually buying ‘SleepDrops’

Furthermore, if the purpose of the IP holding company is simply to protect the IP for the benefit of shareholders in sleep support systems, then why are new shareholders expected to pay a perpetual license fee to you?

Also, why are you unable to tell us the $ amount of the payment you will receive for Nz health systems once the crowd funding is complete? Why is this not listed in the use of capital section?

Hi James, I am sorry but you are incorrect. I can assure you that when I say the IP is held in trust for the benefit of the shareholders it is exactly that. They are buying shares in the holding company that owns SleepDrops. If some large company wants to acquire SleepDrops EVERYONE would benefit from the sale. I can assure you that you are going down the wrong path. I don't need to put anything in the use of capital section if I don't plan on using capital for it. People invest in companies for all sorts of reasons. I personally bought shares in OCHO - the chocolate factory just so I could say I had shares in a chocolate factory. It had no income. Am I happy? Yes I am :) People are investing in SleepDrops for all sorts of reasons including that they believe in our products, the team, our strategy and our company philosophy. We plan on making SleepDrops a fantastic investment on many levels including writing dividend cheques and adding to people's wallets, health and happiness. I think we will leave it there James. Suffice to say you are on the wrong path. Best regards Kirsten

Answered on 26-11-2018 by Kirsten Taylor

Re:”Hi James, I am not sure we are allowed to do that. Sorry but I am going to have to seek legal and accounting advice on that. I believe we have to be consistent and if they are expressed as percentages they have to stay that way. Can I come back to you on that please?”

Sure, thanks. I definitely suggest you get accounting advice on this one. Draw their attention to the fact that new shareholders will have 2m out of a total of 12m shares which =16.67% not 16.5%. Thanks.